Process Flow Diagram

What is MUDRA loan?

As per Department of Financial Services, Ministry of Finance, Govt. of India’s letterNo.27/01/2015-CP/RRB dated May 14, 2015 loans given to non-farm incomegenerating enterprises in manufacturing, trading and services whose credit needsare below Rs.10 lakh by all the Public Sector Banks, Regional Rural Banks, State CooperativeBanks and Urban Co-operative Banks will be known as MUDRA loansunder the Pradhan Mantri MUDRA Yojana (PMMY). All such loans can be coveredunder refinance and/or credit enhancement products of MUDRA.

In addition to these Banks, NBFCs and MFIs operating across the country can alsoextend credit to this segment, for which they can avail financial assistance fromMUDRA Ltd., subject to their conforming to the approved eligibility criteria.Eligibility criteria for availing refinance/financial assistance by institutions fromMUDRA has been finalized and hosted at MUDRA’s website.

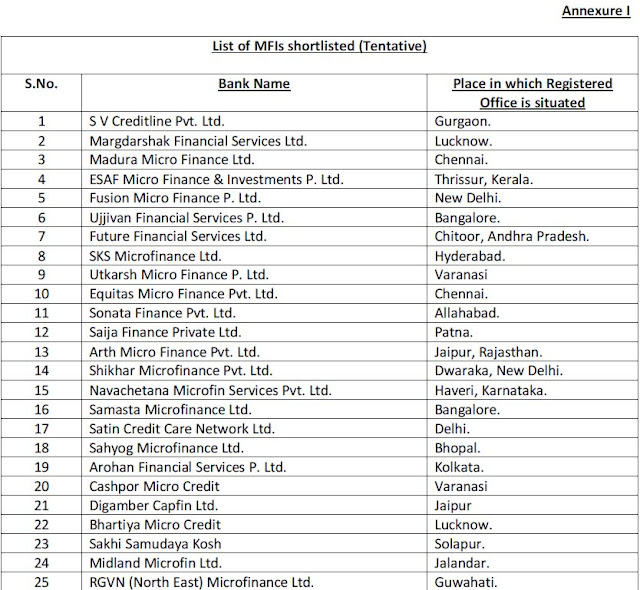

To begin with, based on eligibility criteria, MUDRA has enrolled 27 Public SectorBanks, 17 Private Sector Banks, 27 Regional Rural Banks and 25 Micro FinanceInstitutions (MFIs - list as per Annexure I) as partner institutions for channelizingassistance to the ultimate borrower.

Whom to approach for assistance under PMMY?

Borrowers, who wish to avail assistance under Pradhan Mantri MUDRA Yojana(PMMY), can approach the local branch of any of the above referred institutions intheir region. Sanction of assistance shall be as per the eligibility norms of respectivelending institution.

Whom to contact for assistance?

MUDRA has identified 97 Nodal Officers at various SIDBI Regional offices/BranchOffices to act as “first contact persons” for MUDRA.

For information on MUDRA products and for any kind of assistance, the borrowercan either approach/contact MUDRA office at Mumbai or the identified MUDRANodal Officers, whose details (along with contact numbers and mail ids) are madeavailable at MUDRA’s Website. The borrower may also visit MUDRA website,www.mudra.org.in and can send any query/suggestion to help@mudra.org.in.

Note :1) These institutions have to submit their latest financial status/position and submit loan application for availing of financial assistance from MUDRA Ltd.

2) The MFIs although registered in a particular centre or a state can also operate in othercentres and states, according to their bye laws. Accordingly, these institutions cover most ofthe States.

What is MUDRA loan?

As per Department of Financial Services, Ministry of Finance, Govt. of India’s letterNo.27/01/2015-CP/RRB dated May 14, 2015 loans given to non-farm incomegenerating enterprises in manufacturing, trading and services whose credit needsare below Rs.10 lakh by all the Public Sector Banks, Regional Rural Banks, State CooperativeBanks and Urban Co-operative Banks will be known as MUDRA loansunder the Pradhan Mantri MUDRA Yojana (PMMY). All such loans can be coveredunder refinance and/or credit enhancement products of MUDRA.

In addition to these Banks, NBFCs and MFIs operating across the country can alsoextend credit to this segment, for which they can avail financial assistance fromMUDRA Ltd., subject to their conforming to the approved eligibility criteria.Eligibility criteria for availing refinance/financial assistance by institutions fromMUDRA has been finalized and hosted at MUDRA’s website.

To begin with, based on eligibility criteria, MUDRA has enrolled 27 Public SectorBanks, 17 Private Sector Banks, 27 Regional Rural Banks and 25 Micro FinanceInstitutions (MFIs - list as per Annexure I) as partner institutions for channelizingassistance to the ultimate borrower.

Whom to approach for assistance under PMMY?

Borrowers, who wish to avail assistance under Pradhan Mantri MUDRA Yojana(PMMY), can approach the local branch of any of the above referred institutions intheir region. Sanction of assistance shall be as per the eligibility norms of respectivelending institution.

Whom to contact for assistance?

MUDRA has identified 97 Nodal Officers at various SIDBI Regional offices/BranchOffices to act as “first contact persons” for MUDRA.

For information on MUDRA products and for any kind of assistance, the borrowercan either approach/contact MUDRA office at Mumbai or the identified MUDRANodal Officers, whose details (along with contact numbers and mail ids) are madeavailable at MUDRA’s Website. The borrower may also visit MUDRA website,www.mudra.org.in and can send any query/suggestion to help@mudra.org.in.

Note :1) These institutions have to submit their latest financial status/position and submit loan application for availing of financial assistance from MUDRA Ltd.

2) The MFIs although registered in a particular centre or a state can also operate in othercentres and states, according to their bye laws. Accordingly, these institutions cover most ofthe States.

Comments

Post a Comment